Note: All amounts stated are in Canadian dollars

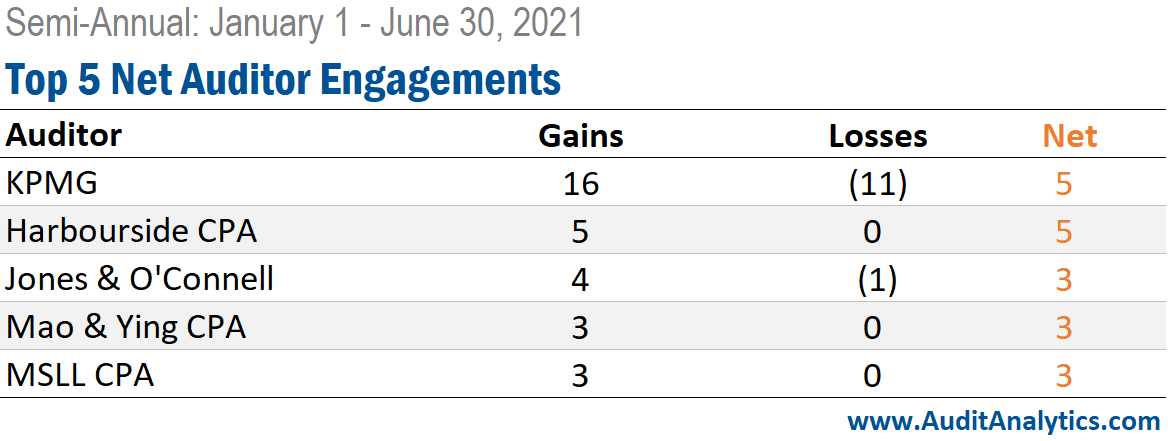

Throughout the first half of 2021, there were 142 new audit engagements and 145 departures among audit firms in Canada. Of these auditor changes, 27 accounting firms posted a net gain in new audit engagement clients during these six months.

“The first half of 2021 was a challenge for Canadian accounting firms and their clients. A second wave of the Covid-19 pandemic roiled the Canadian economy, disrupting business through government-mandated shutdowns, labour shortages and supply chain disruptions. Tax deadlines changed and clients both corporate and individual grasped at financial lifelines from the federal government.

Despite the challenges, many companies thrived, implementing new strategies with long-lasting results. As reported by Canadian Accountant in a five-part series last May, the pandemic accelerated change to the typical business model of accounting firms, as accountants transitioned to remote work, virtual meetings and cloud-based efficiencies. MNP expanded its presence in Quebec, Deloitte scored large public sector coronavirus-related contracts, and KPMG launched its new Finance Plus cloud accounting service.”

– Canadian accountant

The table below presents a comprehensive view of the gains and losses of the Big Four and national firms in Canada during the first half of 2021. It shows the number of SEDAR audit clients each auditor gained or lost, and the auditor from or to which the client was won or lost.

KPMG LLP – with a net of five new SEDAR audit clients – accounts for the most new clients among the auditor changes in the first half of 2021, resulting from 16 client gains and 11 losses. The national audit firm gained a total of $3.4 million in audit fees and increased its market cap by $18.25 billion, primarily through the gain of three large companies:

- Saputo Inc., with a market cap of $16.4 billion;

- AYA Gold & Silver, Inc., with a market cap of $466.1 million; and

- RF Capital Group Inc., with a market cap of $333.6 million.

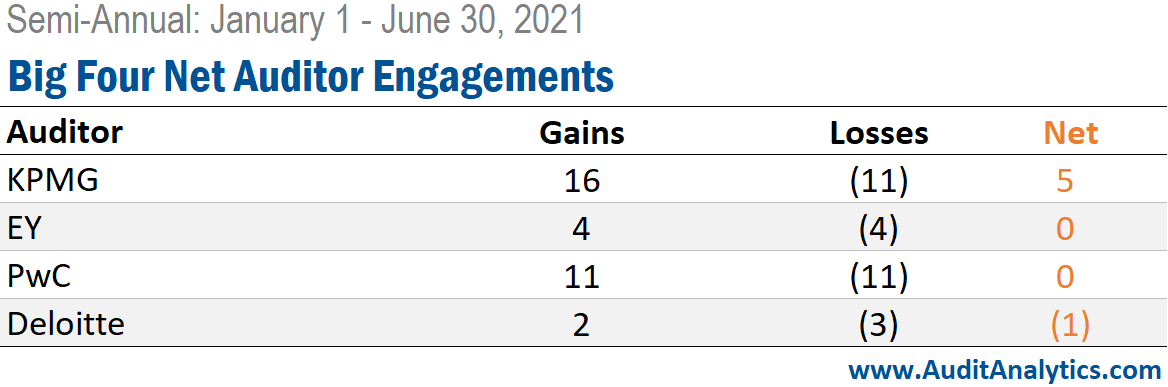

Among the Big Four firms, KPMG was the only auditor with positive net engagements, having 16 gains and 11 losses for a net of five new clients. EY and PwC broke even, while Deloitte had a net loss of one.

KPMG led in market cap gains, bringing in over $18.2 billion. Meanwhile, PwC gained nearly $3.5 billion in net new market cap, primarily driven by the engagement of Stantec Inc., which resulted in a market cap gain of over $6 billion for the Big Four firm.

Grant Thornton broke the top three for net market cap. As mentioned in a Canadian Accountant article, “Market capitalization is a strong indicator of the prestige of a client in terms of engagement work and audit fees. National accounting firm Grant Thornton added Zomedica Corp. (formerly Zomedica Pharmaceuticals Corp.), an American company listed on the TSX Venture Exchange to its roster of clientele. Zomedica has a market cap of $1.7 billion.”

PwC and KPMG topped the charts in terms of total audit fees gained. As mentioned above, PwC saw the majority of their audit fees come from Stantec Inc. KPMG’s increase in audit fees was more diversified over their 16 new clients, but the largest increase of over $3 million came from Saputo Inc.

Manning Elliot followed due to their engagement of BellRock Brands Inc. – which brought in $0.75 million in fees. Marcum also had a presence in the top five gaining about $0.83 million from Jushi Holdings Inc.

This analysis uses data from the Canada Auditor Changes database, powered by Audit Analytics.

Interested in our content? Be sure to subscribe to receive our email notifications.