There were 181 initial public offerings in U.S. markets between April 1, 2021, and June 30, 2021. Together, these IPOs raised over $85.7 billion – a decrease of $48 billion from last quarter and an increase of over $67 billion from the same period last year. Unlike Q1 2021, IPO activity in Q2 was driven by traditional IPOs, which comprised 65.2% of the IPO market.

Audit Analytics recently added a new field to our Initial Public Offerings database, IPO Type. This allows users to easily identify and filter offerings based on the method of going public: traditional IPOs, special purpose acquisition companies (SPACs), or direct listings.

Below is a table presenting this quarter’s IPO breakdown by type.

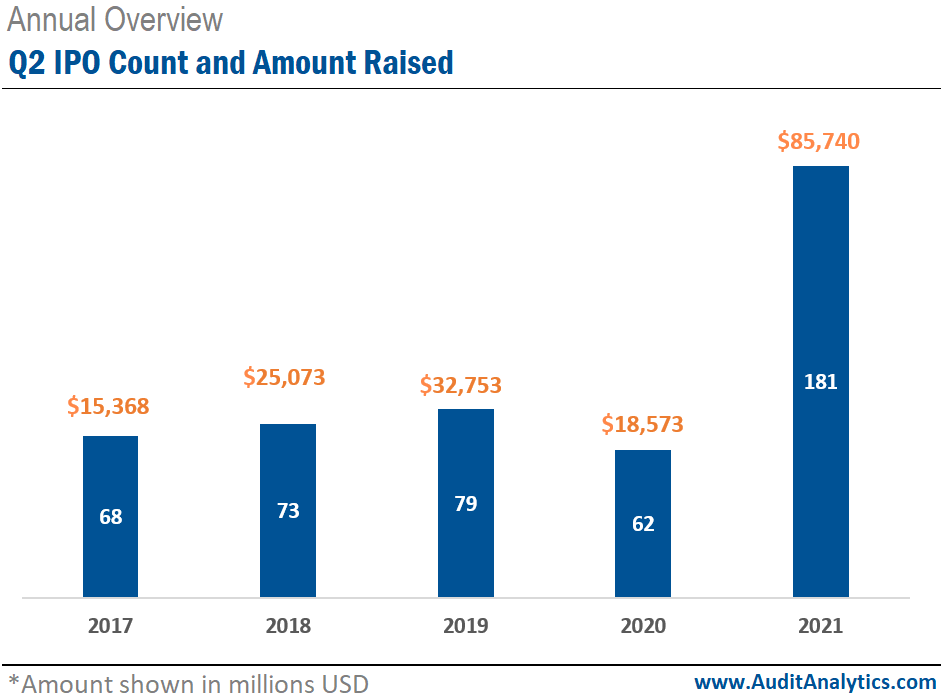

The number of IPOs and amount raised was higher in Q2 2021 than any other second quarter in 21 years. The number of IPOs in Q2 2021 represents a 191.9% increase from Q2 2020; this significant increase can partly be attributed to declines experienced in the IPO market throughout early 2020 related to the COVID-19 pandemic.

As shown in the graph below, the proceeds raised in Q2 2021 ($85.7 billion) is slightly less than all combined proceeds raised in second quarters between 2017 and 2020 ($91.8 billion).

Industry Analysis

There were 13 IPOs with proceeds greater than or equal to $1 billion this quarter. Coinbase Global, Inc. [COIN], a regulated cryptocurrency company, raised over $28.7 billion – topping the charts in terms of proceeds this quarter and ranking as the highest IPO since 2000, as shown in table below. Worth noting, this IPO was not a traditional IPO. Coinbase went public through a direct listing of its shares.

DiDi Global Inc. [DIDI], an operator of passenger transportation platforms company, raised $4.44 billion, placing second this quarter in terms of proceeds, and fourteenth overall since 2000.

Accounting and Legal Representation

The top IPO this quarter, Coinbase Global, Inc., was audited by Deloitte and represented by Fenwick & West and Latham & Watkins. DiDi Global Inc. was audited by PwC and represented by Skadden, Arps, Slate, Meagher & Flom and Simpson Thacher & Bartlett.

Auditor Market Share – All IPOs

Together, the Big Four audited 93 IPOs, or 51.4%, of the IPO market in Q2 2021.

EY led, in terms of count, with 32 total IPO audit clients, which collectively raised over $12.4 billion. Meanwhile, Deloitte’s 24 IPO clients, including Coinbase, raised over $39.8 billion in proceeds, the highest amount this quarter. Worth noting, all of Marcum’s and Withum’s clients were SPACs.

Auditor Market Share – Excluding Special Purpose Acquisition Companies (SPACs)

Out of the 181 IPOs in U.S. markets this quarter, 60 (or 33.1%) were SPACs.

A SPAC is a type of blank check company with the sole purpose of raising capital through the process of an IPO in order to acquire or merge with an existing company.

The table below displays the auditor market share for IPOs in Q2 2021 for traditional IPOs and direct listings, excluding SPACs.

Excluding SPACs, EY, Deloitte, PwC, and KPMG dominated in terms of IPO count and amount raised. Together, the Big Four audited 90 IPOs, or 74.4%, of the IPO market in Q2 2021. As displayed in the table above, excluding SPACs, EY held the top spot this quarter with 31 IPO clients, followed by Deloitte with 24 IPO clients. Deloitte’s 24 traditional IPO and direct listing clients raised the highest amount of aggregate proceeds during the quarter.

Emerging Growth Companies

166 of the 181 IPO companies, or 91.7%, elected to register as emerging growth companies (EGCs) in Q2 2021.

Conclusion

Although Q2 2021 continued this year’s trend of increased IPOs in comparison to previous years, traditional IPOs were the leading offering type for this quarter. SPACs comprised 33.1% of all IPOs, a significant decrease from last quarter, where they accounted for 73.2% of this market.

Interested in our content? Be sure to subscribe to receive our email notifications.