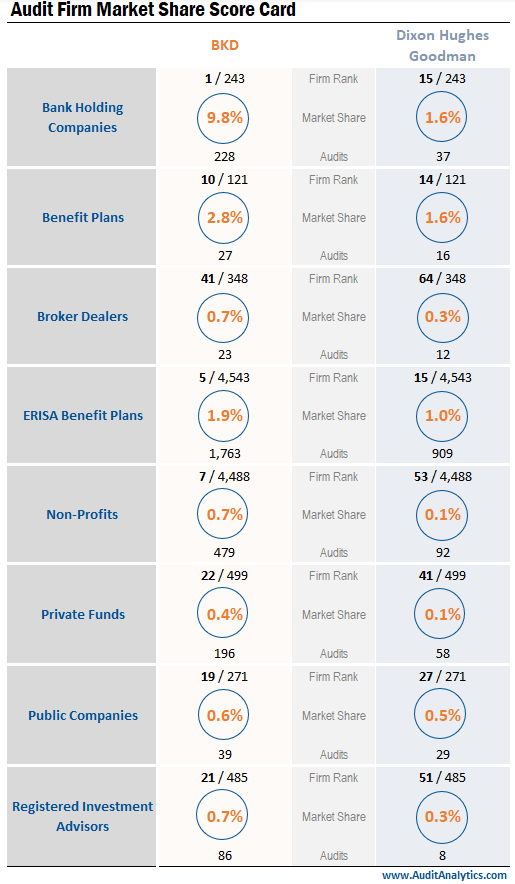

On February 17, 2022, national accounting firms BKD and Dixon Hughes Goodman announced their practices were merging. As of 2021, both are Top 20 firms, according to Accounting Today. The newly combined firm will see a growth in market share across eight audit markets.

Market Share Overall

First, the new combined firm is poised to become the top firm for bank holding company audits. Both BKD and Dixon Hughes Goodman have a slice of the market. In 2020, BKD was the leading auditor in this space, auditing 9.8% of bank holding companies. The addition of Dixon Hughes Goodman’s 1.6% market share comfortably places the merged firm as the top auditor among these entities. For example, the next closest competitor in this space is Crowe, with 9.3% of the market.

The next largest market share of the newly combined firm will be benefit plan audits, followed by ERISA benefit plans.

The benefit plan audit market has the least number of firms participating in audits. During 2020, 121 firms signed benefit plan opinions. BKD held 2.8% of the market share, ranking at number 10. Dixon Hughes Goodman held 1.6%, ranking at number 14. The newly combined firm’s market share is positioned to rank at the top, after the Big Four and BDO.

In the crowded ERISA benefit plan audit market, there are over 4,500 firms participating. As of 2019, BKD ranked at number 5 and Dixon Hughes Goodman ranked at number 15. With the combined market share in this space, the firm could become the second largest auditor of ERISA benefit plans.

The non-profit market is a crowded space. However, BKD ranked at number 7 in 2020, having 0.7% of the market based on the number of entities audited. Meanwhile, Dixon Hughes Goodman held 0.1% of the non-profit market, ranking at number 51.

In addition, the merger between BKD and Dixon Hughes Goodman will boost market share in the other audit spaces. This includes: public companies, broker-dealers, private funds, and registered investment advisers.

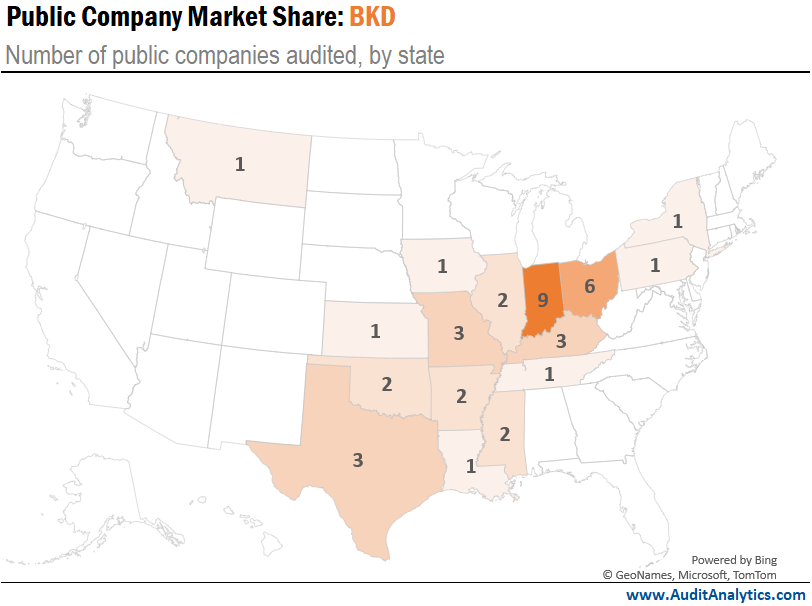

Public Company Geographic Footprint

In the public company market, the new firm is anticipated to become a top-15 auditor in terms of market share. During 2021, BKD audited 39 public companies while Dixon Hughes Goodman audited 29. This amounts to 0.6% and 0.5% of the market, respectively.

As a result of the merger, Missouri-based BKD and North Carolina-based Dixon Hughes Goodman will significantly develop their geographic footprint in this highly competitive space. In particular, in the US Mid-Atlantic, Midwest, and Southeast regions.

Interested in our content? Be sure to subscribe to receive our email notifications.