MNP was the leading audit firm for total new engagements among Canadian auditor changes in calendar year 2022. As one of Canada’s leading firms, MNP pulled in 41 new clients throughout the year. Interestingly, US-based firm BF Borgers saw the most net client engagements in 2022, gaining 20 Canadian clients overall during the year.

Global & National Firms

Overall, there were 152 engagements and 258 departures during 2022 among the Big Four and major global and national firms. Compared to 2021, engagements decreased 11.6% while departures remained nearly identical.

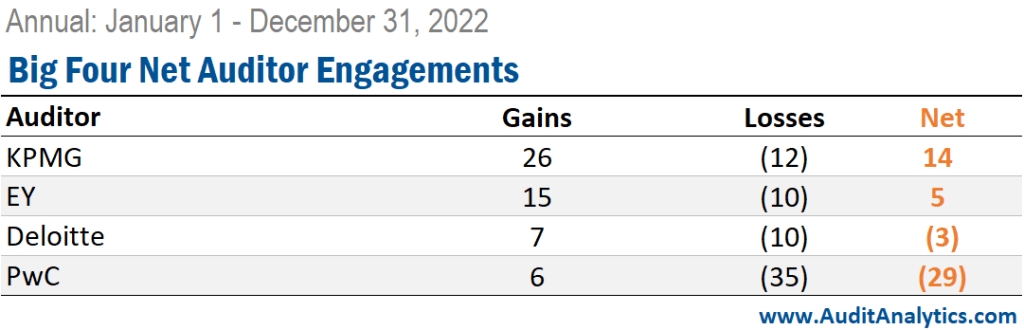

Among the Big Four firms, KPMG saw the most net client gains in 2022. In total, KPMG had 26 new engagements during the year and a net gain of 14 clients. EY also saw positive net gains in 2022, gaining 5 new clients overall. Comparatively, Deloitte had a net loss of three clients, gaining seven and losing ten. However, PwC saw the most client departures in Canada among the Big Four, losing a net of 29 clients throughout the year.

Additionally, all other global and national firms experienced net client losses during 2022. BDO, Grant Thornton, and McGovern Hurley saw the fewest departures, losing a net of one, two, and three clients, respectively. Davidson & Company, a mid-sized firm located in Vancouver, had the most net losses in 2022. The firm had 19 engagements and 63 departures for a total net loss of 44 clients.

Net Auditor Engagements

As previously stated, the Colorado-based firm BF Borgers had the most net client gains in Canada in 2022. KPMG followed with a net gain of 14 clients. As seen in the Audit Analytics Auditor Changes in Canada series, this is the sixth consecutive year KPMG has broken even or netted a positive gain in audit clients.

Kingston Ross Pasnak made the top five net auditor engagements list for the second year in a row. The Alberta firm gained a net of ten clients in 2021, followed by a net gain of 11 clients in 2022.

As for the Big Four, the firms ranked the same in terms of net auditor engagements compared to 2021. KPMG and EY both saw positive net gains while Deloitte and PwC had net losses. Interestingly, PwC had over three times as many net losses in 2022 compared to the previous year.

Market Cap and Audit Fee Gains

Note: Amounts stated in Canadian dollars

PwC saw the largest net market cap during 2022, gaining approximately $16.7 billion from their new clients. The vast majority of this gain came from the addition of George Weston Limited (GWL) as a client, the holding company for Canada’s leading food and drug retailer as well as Canada’s largest real estate investment trust. According to the Canadian Accountant, this is a significant gain for PwC as GWL had been audited by KPMG for over 25 years.

Although, PwC lost a net of 29 clients in the year, this $19.85 billion engagement boosted them as the market cap leader. As the Canadian Accountant put it, “One large cap client is still worth more than a roster of smaller clients.”

Breaking PwC’s two-year reign, Marcum became the leading firm in terms of net audit fees gained in 2022. Marcum was engaged by both TPCO Holding Corp. and SNDL Inc. in 2022, two of the top cannabis companies in California and Canada, respectively. Combined, these new engagements contributed nearly $6.4 million to Marcum’s audit fee gains during the year.

Macias Gini & O’Connell ranked second for net audit fees gained in 2022, due in large part to the addition of Verano Holdings Corp. as a client in September. Another leading US cannabis company, Verano Holdings contributed $3.1 million to Macias Gini & O’Connell’s 2022 audit fee gains.

Interested in our content? Be sure to subscribe to receive our email notifications.