The Division of Enforcement within the U.S. Securities and Exchange Commission “is responsible for detecting and investigating a wide range of potential violations of the federal securities laws and regulations”. The SECs oversight gives them the authority to respond to violations with civil lawsuits in federal court. Furthermore, relating to fraudulent conduct and financial reporting negligence. These responses are otherwise known as Accounting and Auditing Enforcement Releases (AAERs).

The AAER database powered by Audit Analytics looks at records dating back to October 1999 and covers AAERs issued by the SEC. The AAER database is comprised of enforcement actions related to financial reporting brought by the SEC against public and private companies, auditors, law firms, and individuals. The releases contain notices and orders regarding the institution and/or settlement of administrative proceedings. There are numerous ways to analyze this data which include reviewing enforcement action issues, respondent(s) and related parties, and outcomes such as financial penalties, suspensions, and reinstatements. Since October of 1999, the SEC has issued a total of 1,328 AAERs.

The SEC issued about 55% of all AAERs during the first decade of the 21st century. Over the 23 year period, the highest amount recorded in a single year was 92 AAERs. Particularly in both 2002 and 2007. Since 2018, the number of AAERs steadily declined with a subtle increase in 2022.

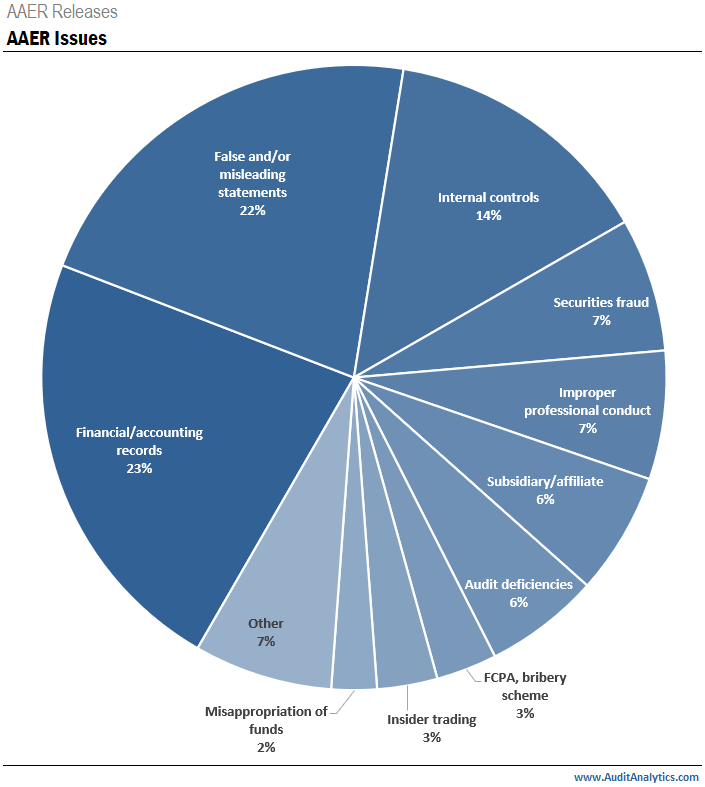

AAER Issues

AAERs define certain issues and violations committed by the respondent(s) or related parties that are believed to have violated the federal securities laws. Audit Analytics identifies these issues and classifies them into several categories. Since October of 1999, there have been a total of 3,877 issues identified within AAERs issued by the SEC. The top 5 issues collectively represent 72% of all AAER issues within our database.

Overall, the leading issue, Financial/Accounting Records represents 23% of all issues. Financial/Accounting Records issues include violations related to a company’s financial statements, false accounting entries, earning manipulation and more. False and/or Misleading Statements followed second, representing 22% of all issues. These violations include instances of lying to auditors or investors. Internal controls include cases where the respondent failed to implement or maintain adequate internal controls over financial reporting, representing 14% of all issues.

Respondent Orders

The SEC has legal authority to obtain court orders for civil enforcement actions in response to a variety of issues and violations committed by the respondent(s). Since October 1999, the SEC issued a total of 3,165 individual orders. The top 5 respondent orders collectively represent 90% of all orders within our database.

In an administrative proceeding, cease and desist was the leading order, representing 32% of all orders. Cease and desist orders requires the respondent to stop all alleged activities related to the violations unquestionably. Financial penalties against regulated entities and/or individuals represent 25% of all respondent orders, which results in fines or disgorgement, frozen assets, and relinquished compensation. Administrative disciplinary proceedings such as bar, prohibition, and suspension represent 24% of all AAER orders.

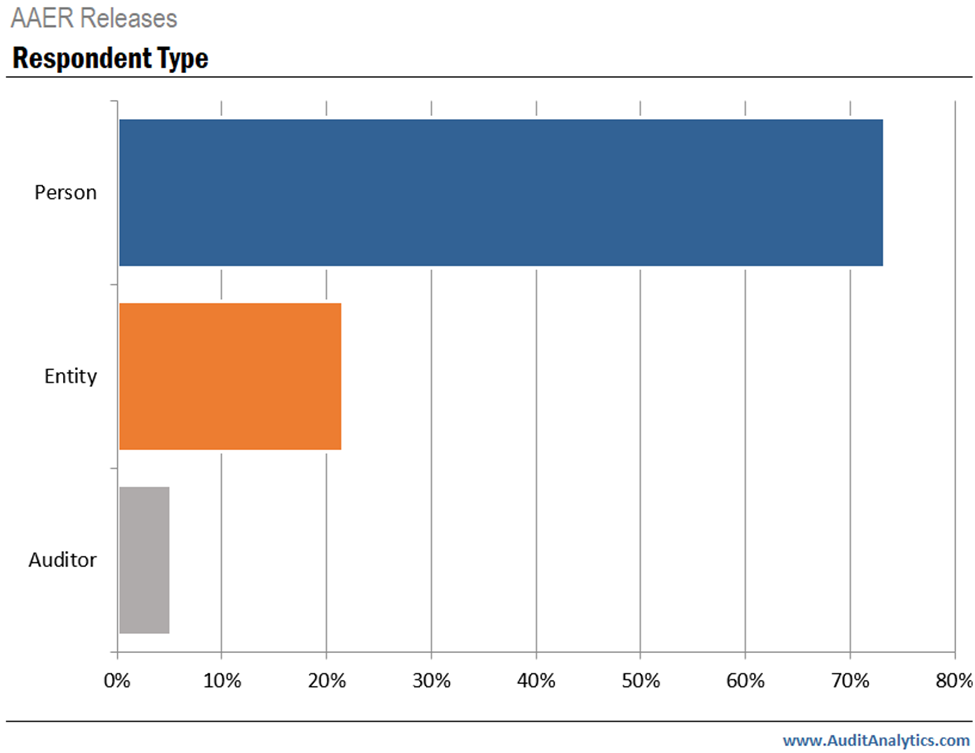

Respondent Type

The SEC issues AAER orders to different types of respondents that include auditors, individuals, and/or entities. Since October of 1999, there have been a total of 3,718 distinct respondents per release who violated the federal securities law. Nearly three-fourths of the respondents were individuals, comprising 73% of all respondents. The most common positions held by these individual respondents are CFOs, CEOs, and CPAs. Entities comprised 22% of all respondent types and auditors comprised 5%.

Interested in our content? Be sure to subscribe to receive our email notifications.