While some numbers in financial statements are relatively straightforward, others can be complex. Some of the more complex figures that are unable to be concretely quantified require management to make significant estimates.

There are many components of financial statements that require some degree of estimation for accounting purposes – including the “useful life” of assets, percentage of completion revenue recognition, restructuring reserves to cover future costs, and provisions for legal contingencies. It’s possible for circumstances to arise that would require making a change to the established accounting estimate.

Why would an accounting estimate change?

For the purposes of comparing financial statements between periods, estimates are expected to remain the same, unless a good reason arises to change them. In terms of disclosing changes in estimates, current regulation ASC 250-10-50-4 prescribes that immaterial and routine changes do not need to be disclosed. However, if the change in estimate is material – meaning it impacts income from continuing operations, net income, related per-share amounts of the current period, etc. – it must be disclosed.

Why are changes in accounting estimates important?

Considering a change in estimate materially affects the operating results of the period in which the change occurs, it’s an information-rich disclosure, specifically with respect to the quality of earnings. Frequent, unusual, or opaque changes in accounting estimates should capture the attention of users of financial statements, as these types of accounting adjustments can have massive impacts on earnings figures.

Due to the usefulness of these disclosures, Audit Analytics tracks all material Changes in Accounting Estimates disclosed in annual and quarterly filings for SEC registrants, capturing the nature of the change, as well as the impact on income and earnings per share; our database currently has just under 11,000 changes in estimates.

How many changes in accounting estimates are disclosed per year?

The number of changes in accounting estimates disclosed per year has fluctuated greatly since 2000; the average across all years is 500.6.

There are notable spikes in disclosures in both 2006 and 2016. In 2006, this can partly be attributed to the implementation of FAS123R, the accounting standard introduced by the Financial Accounting Standards Board (FASB) requiring companies to deduct the amount of share-based (equity) payment granted to their employees annually.

Part of the jump in 2016 can be attributed to estimate changes related to pension plans; there was nearly a five-fold jump in the number of changes in accounting estimates disclosed related to pension plans between 2015 and 2016. Most of the reported changes related to companies switching from the “weighted-average” method of determining a discount rate to use in the present value calculation to the “spot-rate” method.

Outside of 2016, changes in accounting estimates related to pensions are relatively rare, only averaging 15.9 disclosures per year, including 2016; excluding 2016, the average drops to 8.5 per year.

For many companies, the change in accounting estimate related to the adoption of the spot-rate method for pensions improved their results – nearly all of the estimate changes disclosed in 2016 related to pensions and other post-retirement benefits had positive effects (147 positive, 3 negative).

Is there a difference in changes in accounting estimates that have a positive vs. negative impact on income?

Changes in estimates impact a company’s income statement by either increasing or decreasing costs and incomes, meaning that a change in estimate can have a positive or negative impact. Over the 19 year period from 2000 to 2018, positive impacts outnumber negative impacts in nearly every year.

The existence of more disclosed positive impacts suggests that management is more likely to make a change in accounting estimate if it is expected to benefit income. In fact, research has shown that firms are more likely to announce a change in accounting estimate with a positive impact when earnings are likely to miss consensus analyst forecasts. Conversely, firms are more likely to announce a change with a negative impact when earnings already exceed forecasts, and therefore the change is unlikely to lead to negative earnings.

There has been evidence suggesting that financial statements containing changes in accounting estimates with negative effects, compared to financial statements with no estimate changes, are more likely to be misstated – potentially requiring a restatement of financials.

Meanwhile, changes in accounting estimates with positive effects have been found to be more likely to raise inquiries during the SEC review process.

What are common categories of disclosed changes in accounting estimates?

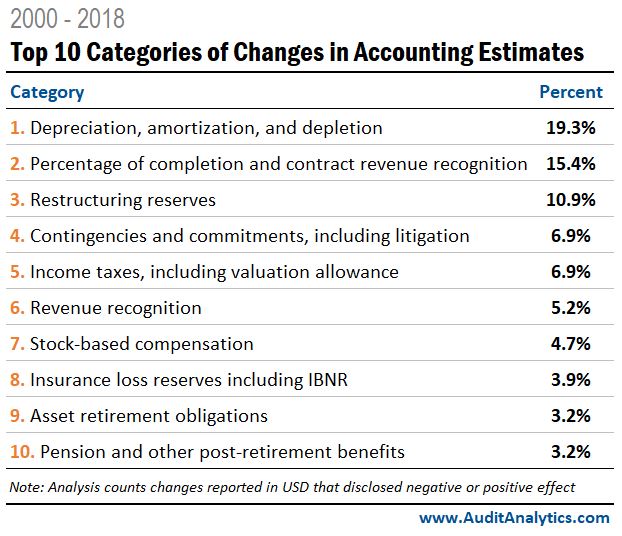

The most common types of changes in accounting estimate relate to depreciation and amortization – almost 1 out of 5 records in the database relate to this category. The next most common issue is percentage of completion and contract accounting revenue recognition.

Compared to our previous analysis of changes in accounting estimates in 2016, the top 3 ranking categories remained the same. Though in a slightly different order, the top 10 categories have remained the same since 2016.

Changes in Accounting Estimates are one of the many quality-of-financial-reporting data-points that we track in our Accounting Quality + Risk Matrix. We’ve discussed before the massive impact such accounting adjustments can have on earnings figures. Interestingly, these adjustments are often not discussed in earnings releases or in earnings conference calls (Netflix provides a past example). Nevertheless, changes in accounting estimates can clearly have an impact on earnings and on comparability, and any user of financial statements would benefit from transparency and disclosure.

This analysis was created using the Changes in Estimates database powered by Audit Analytics.

For more information about this database, or for subscription information, please contact us.