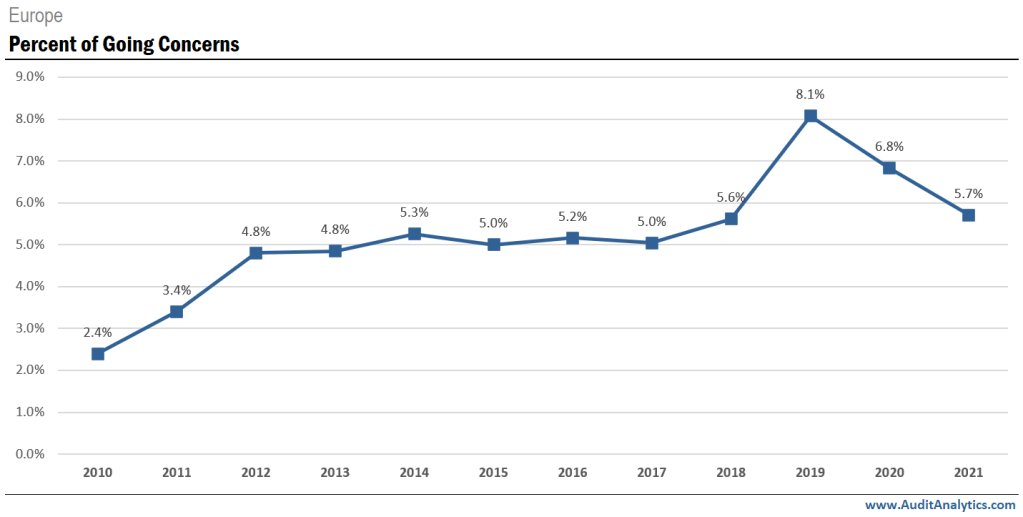

In the last three years, public companies listed on regulated European exchanges have seen the highest rates of going concern opinions over the past twelve years.

Overview

European-listed companies saw the largest increase in going concern opinions in FY2019 since 2010. Going concern opinions increased 42% from FY2018, despite the number of total opinions decreasing in FY2019. This spike is due in large part to the COVID-19 global pandemic. Many auditors were issuing opinions for FY2019 in early 2020 at the height of uncertainty about how the pandemic would affect businesses in the coming year.

Over the past few years, however, going concern rates have been slowly declining. FY2020 saw a 16% decrease in going concern opinions, the largest year-over-year decline over the period observed. Going concern rates decreased again in FY2021 by another 14.5%, bringing the going concern rate back to pre-pandemic figures at 5.7%.

The number of new going concerns issued reached an all-time high in FY 2019, increasing 81.2% from FY2018. New going concerns represent companies that received a clean opinion the previous year but a going concern opinion in the current year.

However, companies saw record high going concern improvements in FY2020, more than doubling from the amount of the previous year. Going concern improvements represents companies that received a going concern opinion in the previous year and a clean opinion in the current year. Europe continued to see more going concern improvements than increases in FY2021.

This trend varies from the one seen for US-listed companies. In 2021, going concern increases greatly exceeded improvements due in large part to newly listed companies with going concerns. The US also did not experience the large spike in going concern rates in FY2019 that was seen in Europe.

Location

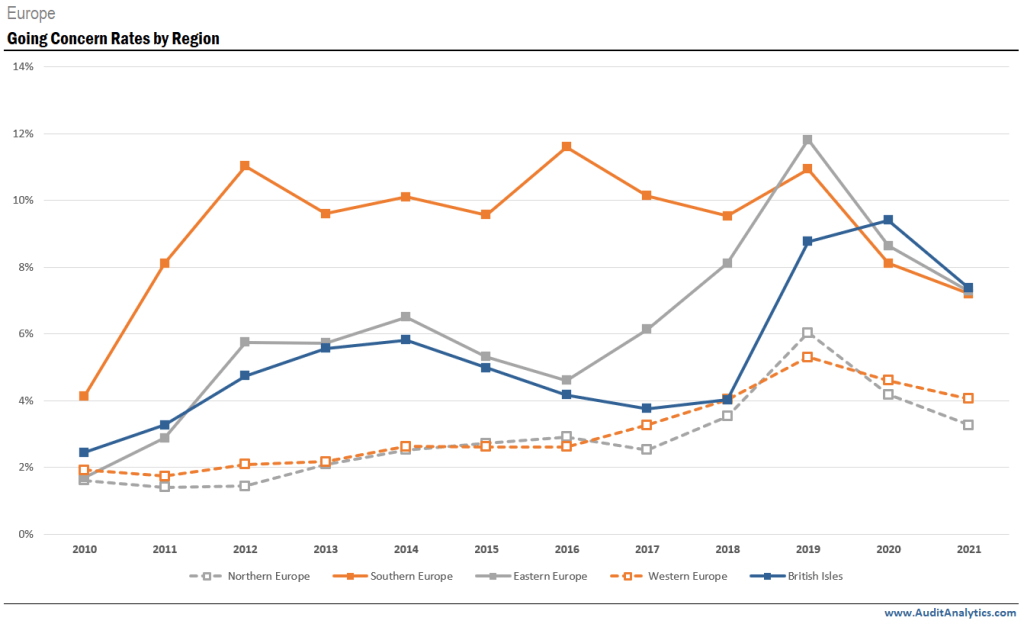

Looking at going concern rates by region, we can see that Southern Europe has had the highest overall going concern rates until FY2019. Eastern Europe saw a significantly large spike in going concerns in FY2019, reaching the highest going concern rate of any region over the period at 11.8%. The British Isles, however, saw the largest year-over-year increase in FY2019, with going concern opinions increasing by 118%.

In 2021, going concern rates decreased across all regions. Southern and Eastern Europe, as well as the British Isles, all dropped to a similar going concern rate of around 7%. Western Europe dropped to 4.1%, while Northern Europe had the lowest FY2021 going concern rate at 3.3%.

Companies from all over the world can be listed on European stock exchanges. Here, we look at the difference in going concern rates between companies headquartered in Europe compared to those located outside of Europe.

Although they begin with very similar rates in 2010, the percentage of going concern opinions for companies located outside of Europe quickly begin to exceed European numbers. While European-headquartered companies reached their peak in FY2019, going concern rates continued to rise for global companies into 2020. FY2020 saw the greatest disparity in going concern rates at an 8.3 percentage point difference.

Both European and global companies saw decreases in going concern rates in FY 2021, dropping 15% and 10% respectively.

Company Size

Each European stock exchange has multiple market indices representing the top companies on each exchange. For example, the FTSE 100 market index is made up of the top 100 companies listed on the London Stock Exchange. In the chart above, we explore how these top companies compare to the rest of the regulated market in terms of going concern rates.

Overall, index companies have a significantly lower rate of going concern opinions than those not listed on a market index. Index companies reached their highest going concern rate in FY2020 at 2.4%, more than doubling the rate from FY2018. Non-index companies peaked in FY2019 at 11.3%, with going concern opinions increasing 37.5% from the previous fiscal year.

Both groups saw improvements in going concern rates in FY2021. Index companies dropped one percentage point to a rate of 1.4%, still slightly higher than pre-pandemic figures. Non-index companies fell to 8.1%, a 28% decrease in going concern opinions from FY2019.

Interested in our content? Be sure to subscribe to receive our email notifications.