The number of (conspiracy) theories surrounding the recent bankruptcy of GT Advanced Technologies (GTAT) may soon exceed the number of words found in their last annual report. People eagerly speculate: was it mismanagement? an attack from Apple? a combination of the two?

In reality, what matters is why such a grim end was not foreseeable from the company’s financial statements. Many commentators were shocked by the announcement. But was was it really so unforeseen? As pointed out by Footnoted.com, the terms of the Apple agreement, which GTAT now claims to have been unduly burdensome and unfair, were disclosed clearly in the Risk Factors section. GTAT was to receive prepayment for their future product from Apple, if certain conditions were met. Apple did not have any obligations to purchase anything from GTAT, and GTAT was to repay Apple should there be no purchase.

Another crucial piece was disclosed in the non-GAAP section of the August 4th press release (and later expanded in the quarterly report). In the non-GAAP section, one of the lines reconciling GAAP and non-GAAP incomes was related to “production ramp-up costs” that, according to the company, mostly consisted of “costs in connection with production inefficiencies and inventory losses as a result of the qualification of sapphire growth and fabrication equipment and the establishment of related production processes”. What does that mean in plain English? One likely interpretation is that GT Advanced was hitting bumps on the way to scale the technology to Apple’s standards, and that receiving the last installment of cash was far from guaranteed.

Opponents of non-GAAP disclosures have long argued that the metrics should be called “earnings before all the bad stuff”, and that excessive use of non-GAAP can be used to divert attention from deteriorating fundamentals. The argument is not new: Regulation G explicitly prohibits presentation of carve-out financial statements on a non-GAAP basis. If undue reliance on non-GAAP is suspected, the SEC may, as part of the routine comment letters process, ask a company to remove the inappropriate disclosure. Further, companies that choose to disclose non-GAAP must reconcile the non-GAAP to the most comparable GAAP metric.

While the vast majority of companies do reconcile the metrics, does it really help the average investor? The Gunning Fog Index[i] is one of the easiest ways to evaluate the readability of text. We divided 8-K’s that contained non-GAAP reconciliations into two parts: the first part with the discussion of actual results of operations, and the second part that included “Use of Non-GAAP Metrics” information. Not surprisingly, the Fog Index for the results of operations part was in the 12 range for most companies, while for the discussion non-GAAP metrics the Index in many cases exceeded 20.[ii] Anything beyond 18 is considered unreadable. Based on Li (2008), the median Fog for annual reports was 19.24. In other words, non-GAAP disclosures may prove to be too difficult for the average investor (or anyone) to understand.

To evaluate reliance on non-GAAP metrics, we used a simple algorithm that counted the number of “non-GAAP” words in a press release.[iii] Based on our analysis of 8-K filings filed between July 1st and September 30th, 2013, 67% of Russell 3000 companies used non-GAAP terms at least once, while 20% used the non-GAAP word at least 20 times.

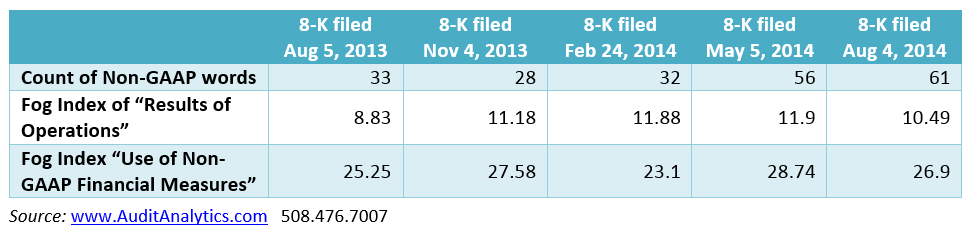

Let’s look again at GTAT’s non-GAAP disclosure.

As you can see, the number of non-GAAP references in the company’s 8-Ks almost doubled from August 2013 to August 2014. Further, the Fog Index of the non-GAAP section was high above the “unreadable” level in each instance, peaking at nearly 29 in May 2014. In other words, over the course of a year, GTAT apparently increased its reliance on non-GAAP measures, and, based on the Fog Index, made their public disclosures even harder to decipher. Part of it came from additional items eliminated in reconciliation, such as “productions ramp-up costs” and from presentation of additional non-GAAP lines, such as non-GAAP operating margin, in the “Results of Operations” section.

Granted, the count of “non-GAAP” hits is not the only metric that should be used to evaluate reliance on non-GAAP presentation. Many knowledge-intensive companies, such as Google, heavily rely on non-GAAP language. Instead, we used the non-GAAP count only as an initial filter for the sake of simplicity. Other metrics include the number of items eliminated in the non-GAAP reconciliation, and the total difference between GAAP and non-GAAP income. As an example, positive non-GAAP income and negative GAAP income that persists quarter after quarter may point to aggressive use of non-GAAP disclosure.

One thing is certain, though: non-GAAP metrics frequently provide valuable disclosure that should not be overlooked.

[i] Li (2008) found that on average companies with higher Fog Index are associated with lower earnings persistence. Lehavy, Li and Merkley (2011) suggested that investors need to rely on analyst’s coverage for firms with less readable communication.

[ii] We used the following free resource to calculate Fog Index: http://gunning-fog-index.com/fog.cgi

[iii] We searched all the 8-K’s released between July 1st, 2013 and September 30th, 2013 (calendar Q2 of 2013) using the following algorithm: “non” within 5 characters of “GAAP”. Some companies tend to present extensive amount of non-GAAP data while using the “non-GAAP” string only once. Other companies may avoid using “non-GAAP” string altogether by using descriptions such as “non-core” or “adjusted”. Therefore, the frequency of the word “non-GAAP” may not necessarily capture all the instances of extensive reliance on the non-GAAP disclosure. Instead, the metric measures extensive reliance on non-GAAP language.

[iv] We defined heavy reliance on non-GAAP language as at least 20 non-GAAP hits in a single document.