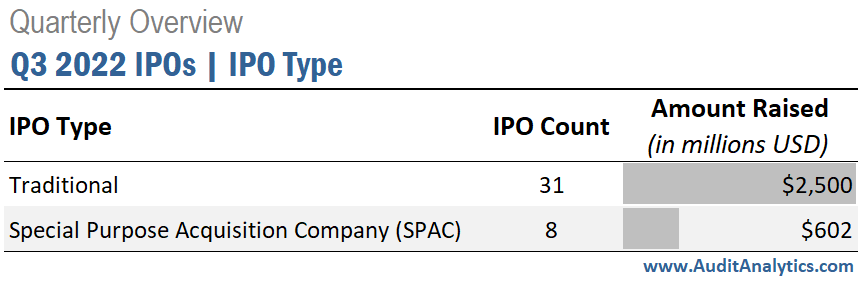

The number and size of initial public offerings (IPOs) continued to decline during the third quarter of 2022. There were 39 IPOs during Q3 that raised a combined $3.1 billion. This aligns IPO numbers with what was previously seen in Q1 2021 (38). Q3’s amount raised was the smallest amount raised since Q1 2016 ($2.9 billion).

Both traditional and SPAC IPOs continued the decline seen throughout 2022.

Compared to Q3 2021, the number of traditional IPOs declined by 72%. Similarly, the number of SPAC IPOs declined by 91%. Based on the amount raised, traditional IPOs fell by 100%, and SPAC IPOs fell by 96% compared to last year’s third quarter.

Unicorn IPOs

During Q3 2022, Corebridge Financial Inc. [CRBG] was the only company to raise more than $1 billion at the time of its traditional IPO. Corebridge Financial, formerly known as AIG Life & Retirement, is a Texas-based public company providing retirement solutions and insurance products. The company began trading at about $21 per share on September 15, 2022. The company’s share price has remained stable since the IPO.

Auditor Market Share – All IPOs

Twenty different firms audited the 39 companies that completed IPOs during Q3 2022.. Friedman led with seven IPO clients. BF Borgers and Marcum followed with four clients each. Friedman and Marcum merged as of September 1, 2022.

The only firm to raise over $1 billion from IPO proceeds in Q3 2022 was PwC, which audited the sole unicorn of the quarter.

Auditor Market Share – Excluding SPACs

When excluding SPACs, there were 20 firms that audited 31 companies. Friedman led with five clients. BF Borgers, Deloitte, Ziv Haft, and Grassi & Co were the only other firms with multiple IPO clients.

Due to the oversaturation of the SPAC market, SPACs are failing to find appropriate private companies to take public. During Q3 2022, Chamath Palihapitiya, known as the SPAC King, closed two SPACs (Social Capital Hedosophia IV and VI), returning over $1.6 billion to investors after the SPACs failed to find targets.

Additionally, with looming fears of a recession, the number of IPOs will likely remain depressed, far below the levels seen in 2021.

Interested in our content? Be sure to subscribe to receive our email notifications.